N-CSR: Certified Shareholder Report

Published on June 5, 2025

| (a) |

| 3 | ||||

| 5 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 14 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 34 | ||||

| 36 | ||||

| Gladstone Alternative Income Fund | Shareholder Letter | |

| March 31, 2025 (Unaudited) |

Holdings |

Percentage |

|||

United States Treasury Bill |

33.73 | % | ||

Morgan Stanley ILF (Government Portfolio) |

19.41 | % | ||

Ricardo Defense, Inc. (Term Loan) |

12.36 | % | ||

Vet’s Choice Radiology LLC (Term Loan) |

7.59 | % | ||

Viron International, LLC (Term Loan) |

7.26 | % | ||

Industry |

Percentage |

|||

Sovereign |

33.73 | % | ||

Cash & Money Markets |

21.61 | % | ||

Aerospace & Defense |

15.86 | % | ||

Healthcare, Education & Childcare |

7.59 | % | ||

Diversified/Conglomerate Manufacturing |

7.26 | % | ||

Food & Tobacco |

7.09 | % | ||

Electronics |

6.85 | % | ||

Holdings |

Percentage |

|||

Dutch Good Honey (Term Loan) |

6.75 | % | ||

Nielsen-Kellerman Acquisition Corp. (Term Loan) |

4.62 | % | ||

Ricardo Defense, Inc. (Preferred Stock) |

3.50 | % | ||

Cash and Equivalents |

2.20 | % | ||

Nielsen-Kellerman Acquisition Corp. (Preferred Stock) |

2.13 | % | ||

Asset |

Percentage |

|||

Direct Lending (Floating Rate) |

38.67 | % | ||

Treasury Bills |

33.73 | % | ||

Cash & Money Markets |

21.61 | % | ||

Equities (Private, Preferred) |

5.98 | % | ||

| Annual Report | March 31, 2025 (Unaudited) | 3 | |

| Gladstone Alternative Income Fund | Shareholder Letter | |

| March 31, 2025 (Unaudited) |

1 |

U.S. Treasury obligations, short-term investments and reverse repurchase agreements are not included in this discussion of the Fund’s portfolio. |

| 4 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund | Schedule of Investments | |

| March 31, 2025 |

Equity Investments - 8.79% |

Shares | Value | ||||||

Food & Tobacco |

||||||||

Dutch Gold Honey Ingredients, LLC (Class A Units) (a)(b)(c)

|

100,000 | $ | 100,000 | |||||

Electronics |

||||||||

Nielsen-Kellerman Acquisition Corp. (Preferred A Stock) (a)(b)(d)

|

3 | 3,009 | ||||||

Nielsen-Kellerman Acquisition Corp. (Preferred B Stock) (a)(b)(d)

|

628 | 635,337 | ||||||

Aerospace & Defense |

||||||||

GP Defense Investments LLC (Class B Units) (a)(b)(d)

|

1,039 | 1,038,534 | ||||||

Diversified/Conglomerate Manufacturing |

||||||||

Viron International, LLC (Common Stock) (a)(b)(c)

|

50 | 1,717 | ||||||

Total Equity Investments (Cost $1,771,393) |

$ |

1,778,597 |

||||||

Debt Investments - 56.61% |

Rate |

Maturity Date |

Principal Amount |

Value | ||||||||||

Food & Tobacco |

||||||||||||||

Dutch Gold Honey, Inc. (Secured Second Lien Debt) (b)(c)

|

Term SOFR + 7.5%, 2% Floor | 8/4/2030 | $ | 2,000,000 | $ | 2,000,000 | ||||||||

Electronics |

||||||||||||||

Nielsen-Kellerman Co. (Secured First Lien Debt) (b)(d)

|

Term SOFR + 8.5%, 13.5% Floor | 12/19/2029 | 1,368,858 | 1,375,702 | ||||||||||

Nielsen-Kellerman Co. (Line of Credit) (b)(d)

|

Term SOFR + 5%, 10% Floor | 12/19/2025 | 30,450 | 30,602 | ||||||||||

Aerospace & Defense |

||||||||||||||

Ricardo Defense, Inc. (Secured First Lien Debt) (b)(d)

|

Term SOFR + 9%; 13% Floor | 12/31/2029 | 3,661,466 | 3,661,466 | ||||||||||

Healthcare, Education & Childcare |

||||||||||||||

Vet’s Choice Radiology LLC (Secured First Lien Debt) (b) (c) |

Term SOFR + 7%, 10% Floor | 12/17/2027 | 2,250,000 | 2,242,350 | ||||||||||

Diversified/Conglomerate Manufacturing |

||||||||||||||

Viron International Buyer, LLC (Secured First Lien Debt) (b)(c)

|

Term SOFR + 7% | 2/7/2030 | 2,150,000 | 2,150,000 | ||||||||||

Total Debt Investments (Cost $11,460,774) |

$ |

11,460,120 |

||||||||||||

United States Treasury Obligations - 49.39% |

Rate |

Maturity Date |

Principal Amount |

Value | ||||||||||

United States Treasury Bill (e)

|

4.10% | 4/1/2025 | $ | 10,000,000 | $ | 9,998,597 | ||||||||

Total United States Treasury Obligations (Cost $10,000,000) |

$ |

9,998,597 |

||||||||||||

Investments, at fair value |

$ | 23,237,314 | ||||||||||||

| Annual Report | March 31, 2025 | 5 | |

| Gladstone Alternative Income Fund | Schedule of Investments | |

| March 31, 2025 |

Short Term Investments - 28.42% |

7 Day Yield | Shares | Value | |||||||||||

Money Market Fund - 28.42% |

||||||||||||||

Morgan Stanley Institutional Liquidity Government Fund (f)

|

4.26 | % | 5,753,059 | $ | 5,753,059 | |||||||||

Total Short Term Investments Cost ($5,753,059) |

$ |

5,753,059 |

||||||||||||

Total Investments - 143.21%; Cost ($28,985,226) |

$ | 28,990,373 | ||||||||||||

Liabilities in Excess of Other Assets (43.21%) |

(8,747,400 | ) | ||||||||||||

Net Assets - 100.00% |

$ |

20,242,973 |

||||||||||||

(a) |

Non-income producing security. |

(b) |

As a result of the use of significant unobservable inputs to determine fair value, these investments have been classified as Level 3 securities under the fair value hierarchy. |

(c) |

One of our affiliated funds, Gladstone Capital Corporation, co-invested with us in this portfolio company pursuant to an exemptive order granted by the U.S. Securities and Exchange Commission. |

(d) |

One of our affiliated funds, Gladstone Investment Corporation, co-invested with us in this portfolio company pursuant to an exemptive order granted by the U.S. Securities and Exchange Commission. |

(e) |

All or partial amount transferred for the benefit of the counterparty as collateral for reverse repurchase agreements. |

(f) |

The rate shown is the annualized 7-day yield as of March 31, 2025. |

Counterparty |

Interest Rate |

Acquisition Date |

Maturity Date |

Amount Borrowed |

Amount Payable |

|||||||||||||||

UMB |

5.21 | % | 03/27/2025 | 04/01/2025 | $ | 9,000,000 | $ | 9,005,134 | ||||||||||||

| 6 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund | Statement of Assets and Liabilities | |

| March 31, 2025 |

ASSETS |

||||

Investments, at fair value (Cost $23,232,167) |

$ | 23,237,314 | ||

Short-term investments, at fair value (Cost $5,753,059) |

5,753,059 | |||

Dividend and interest receivable |

124,631 | |||

Deferred offering costs |

534,329 | |||

Receivable due from Adviser (Note 7) |

1,096,997 | |||

Prepaid expenses and other assets |

63,686 | |||

Total assets |

30,810,016 | |||

LIABILITIES |

||||

Payable for investments purchased |

5,676 | |||

Distributions payable to common shareholders |

106,633 | |||

Administration and fund accounting fees payable |

26,597 | |||

Administrative reimbursement payable to the Administrator (Note 7) |

258,775 | |||

Transfer agent fees payable |

46,074 | |||

Distribution and shareholder servicing fee payable (Note 7) |

484 | |||

Offering costs payable to Adviser |

615,125 | |||

Trustees fees and expenses payable |

862 | |||

Payable for reverse repurchase agreement, including accrued interest of $5,134 |

9,005,134 | |||

Organizational expenses payable to Adviser |

387,653 | |||

Accrued expenses and other liabilities |

114,030 | |||

Total liabilities |

10,567,043 | |||

Commitments and contingencies (Note 2) |

||||

NET ASSETS |

$ | 20,242,973 | ||

COMPONENTS OF NET ASSETS |

||||

Paid-in capital |

$ | 20,234,000 | ||

Distributable Earnings/(Losses) |

8,973 | |||

NET ASSETS |

$ | 20,242,973 | ||

Net Assets By Share Class |

||||

Class I Shares |

$ | 19,909,303 | ||

Class C Shares |

99,740 | |||

Class A Shares |

233,930 | |||

| $ | 20,242,973 | |||

Shares of Beneficial Interest Outstanding (unlimited number of shares of no par value): |

||||

| 2,023,400 | ||||

Net Asset Value per Share: |

||||

Class I Shares |

$ | 10.00 | ||

Class C Shares |

$ | 9.97 | ||

Class A Shares |

$ | 10.00 |

| Annual Report | March 31, 2025 | 7 | |

| Gladstone Alternative Income Fund | Statement of Operations | |

For the Period December 9, 2024 (Commencement of Operations) to March 31, 2025 |

||||

INVESTMENT INCOME |

||||

Dividend income |

$ | 96,664 | ||

Interest income |

355,172 | |||

Total investment income |

451,836 | |||

EXPENSES |

||||

Administration and fund accounting fees |

72,961 | |||

Administrative reimbursement to the Administrator (Note 7) |

336,886 | |||

Transfer agent fees |

66,431 | |||

Distribution and shareholding servicing fee - Class A (Note 7) |

179 | |||

Distribution and shareholding servicing fee - Class C (Note 7) |

305 | |||

Professional fees |

152,966 | |||

Amortization of offering costs |

239,600 | |||

Custodian fees |

17,251 | |||

Interest expense |

12,956 | |||

Trustees’ fees and expenses |

124,585 | |||

Total expenses |

1,024,120 | |||

Less expenses waived and reimbursed by Adviser (Note 7) |

(682,743 | ) | ||

Net expenses |

341,377 | |||

NET INVESTMENT INCOME |

$ | 110,459 | ||

NET REALIZED GAIN/(LOSS) AND CHANGE IN UNREALIZED APPRECIATION/(DEPRECIATION) FROM INVESTMENTS |

||||

Net change in unrealized appreciation/(depreciation) on Investments |

$ | 5,147 | ||

NET REALIZED GAIN/(LOSS) AND CHANGE IN UNREALIZED APPRECIATION/(DEPRECIATION) ON INVESTMENTS |

5,147 | |||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 115,606 | ||

| 8 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund | Statements of Changes in Net Assets | |

For the Period December 9, 2024 (Inception) to March 31, 2025 |

||||

OPERATIONS |

||||

Net investment income |

$ | 110,459 | ||

Net realized gain/(loss) from Investments |

— | |||

Net change in unrealized appreciation/(depreciation) from Investments |

5,147 | |||

Net increase in net assets resulting from operations |

115,606 | |||

DISTRIBUTIONS |

||||

Class I |

(104,873 | ) | ||

Class C |

(527 | ) | ||

Class A |

(1,233 | ) | ||

Net decrease in net assets from distributions |

(106,633 | ) | ||

SHARE TRANSACTIONS |

||||

Class I |

||||

Proceeds from shares issued |

19,800,000 | |||

Net increase from share transactions |

19,800,000 | |||

Class C |

||||

Proceeds from shares issued |

100,000 | |||

Net increase from share transactions |

100,000 | |||

Class A |

||||

Proceeds from shares issued |

234,000 | |||

Net increase from share transactions |

234,000 | |||

Net increase in net assets from share transactions |

20,134,000 | |||

NET ASSETS |

||||

Beginning of period (Note 1) |

100,000 | |||

End of period |

$ | 20,242,973 | ||

Fund Share Transactions |

||||

Class I |

||||

Shares Sold |

1,980,000 | |||

Net increase in shares outstanding |

1,980,000 | |||

Class C |

||||

Shares Sold |

10,000 | |||

Net increase in shares outstanding |

10,000 | |||

Class A |

||||

Shares Sold |

23,400 | |||

Net increase in shares outstanding |

23,400 | |||

| Annual Report | March 31, 2025 | 9 | |

| Gladstone Alternative Income Fund | Statement of Cash Flows | |

For the Period December 9, 2024 (Inception) to March 31, 2025 |

||||

Cash Flows from Operating Activities: |

||||

Net increase in net assets resulting from operations |

$ | 115,606 | ||

Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: |

||||

Purchase of Investments |

(33,220,006 | ) | ||

Sale of Investments |

10,000,000 | |||

Proceeds from securities sold short transactions |

(5,753,059 | ) | ||

Net change in unrealized appreciation/(depreciation) on Investments |

(5,147 | ) | ||

Discount and premiums amortized |

(12,161 | ) | ||

Amortization of offering costs |

239,600 | |||

(Increase)/Decrease in Assets: |

||||

Interest receivable |

(124,631 | ) | ||

Due from Adviser |

(682,743 | ) | ||

Prepaid expenses and other assets |

(63,686 | ) | ||

Increase/(Decrease) in Liabilities: |

||||

Payable for investments purchased |

5,676 | |||

Administration and fund accounting fees payable |

26,597 | |||

Transfer agent fees payable |

46,074 | |||

Distribution and shareholding servicing fee payable |

484 | |||

Offering costs payable to Adviser |

(158,804 | ) | ||

Trustees fees and expenses payable |

862 | |||

Administrative fee reimbursement payable to Administrator |

258,775 | |||

Interest due on reverse repurchase agreement |

5,134 | |||

Organizational expenses payable to Adviser |

(26,601 | ) | ||

Accrued expenses and other liabilities |

114,030 | |||

Net cash used in operating activities |

(29,234,000 | ) | ||

Cash Flows from Financing Activities: |

||||

Proceeds from shares issued |

20,134,000 | |||

Cash distributions paid |

— | |||

Securities purchased under reverse repurchase agreement |

18,000,000 | |||

Securities sold under reverse repurchase agreement |

(9,000,000 | ) | ||

Net cash provided by financing activities |

29,134,000 | |||

Cash & cash equivalents, beginning of period |

$ | 100,000 | ||

Net change in cash & cash equivalents |

$ | (100,000 | ) | |

Cash & cash equivalents, end of period |

$ | — | ||

Non-Cash Financing Activities: |

||||

Distributions payable |

$ | (106,633 | ) | |

| 10 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund | Financial Highlights - Class I | |

| March 31, 2025 |

For the Period December 9, 2024 (Commencement of operations) to March 31, 2025 |

||||

NET ASSET VALUE, BEGINNING OF PERIOD |

$ | 10.00 | ||

INCOME FROM INVESTMENT OPERATIONS |

||||

Net investment income (a)

|

0.06 | |||

Net realized and unrealized loss on investments (a)

|

(0.01 | ) | ||

Total income from investment operations (a)

|

0.05 | |||

DISTRIBUTIONS |

||||

From net investment income (a)

|

(0.05 | ) | ||

Total distributions (a)

|

(0.05 | ) | ||

NET ASSET VALUE, END OF PERIOD |

$ | 10.00 | ||

TOTAL RETURN (b)

|

0.53 | % | ||

RATIOS AND SUPPLEMENTAL DATA |

||||

Net assets, end of period (000’s) |

$ | 19,909 | ||

RATIOS TO AVERAGE NET ASSETS |

||||

Ratio of gross expenses to average net assets |

17.23 | % (c) |

||

Ratio of expense waiver/reimbursements to average net assets |

(11.49 | %) (c) |

||

Ratio of net expenses to average net assets |

5.74 | % (c) |

||

Ratio of net investment income to average net assets |

1.87 | % (c) |

||

PORTFOLIO TURNOVER RATE |

0 | % | ||

(d) |

Per share numbers have been calculated using the average shares method. |

(e) |

Based on net asset value per share. Distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s Dividend Reinvestment Plan. Total return is not annualized for periods less than one year. |

|

(f) |

Annualized (except organizational costs and non-recurring expenses). |

| Annual Report | March 31, 2025 | 11 | |

| Gladstone Alternative Income Fund | Financial Highlights - Class C | |

| March 31, 2025 |

For the Period December 9, 2024 (Commencement of operations) to March 31, 2025 |

||||

NET ASSET VALUE, BEGINNING OF PERIOD |

$ | 10.00 | ||

INCOME FROM INVESTMENT OPERATIONS |

||||

Net investment income (a)

|

0.02 | |||

Total income from investment operations (a)

|

0.02 | |||

DISTRIBUTIONS |

||||

From net investment income (a)

|

(0.05 | ) | ||

Total distributions (a)

|

(0.05 | ) | ||

NET ASSET VALUE, END OF PERIOD |

$ | 9.97 | ||

TOTAL RETURN (b)

|

0.23 | % | ||

RATIOS AND SUPPLEMENTAL DATA |

||||

Net assets, end of period (000’s) |

$ | 100 | ||

RATIOS TO AVERAGE NET ASSETS |

||||

Ratio of gross expenses to average net assets |

18.57 | % (c) |

||

Ratio of expense waiver/reimbursements to average net assets |

(12.00 | %) (c) |

||

Ratio of net expenses to average net assets |

6.57 | % (c) |

||

Ratio of net investment income to average net assets |

0.79 | % (c) |

||

PORTFOLIO TURNOVER RATE |

0 | % | ||

|

(a) |

Per share numbers have been calculated using the average shares method. |

|

(b) |

Based on net asset value per share. Distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s Dividend Reinvestment Plan. Total return is not annualized for periods less than one year. |

|

(c) |

Annualized (except organizational costs and non-recurring expenses). |

| 12 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund | Financial Highlights - Class A | |

| March 31, 2025 |

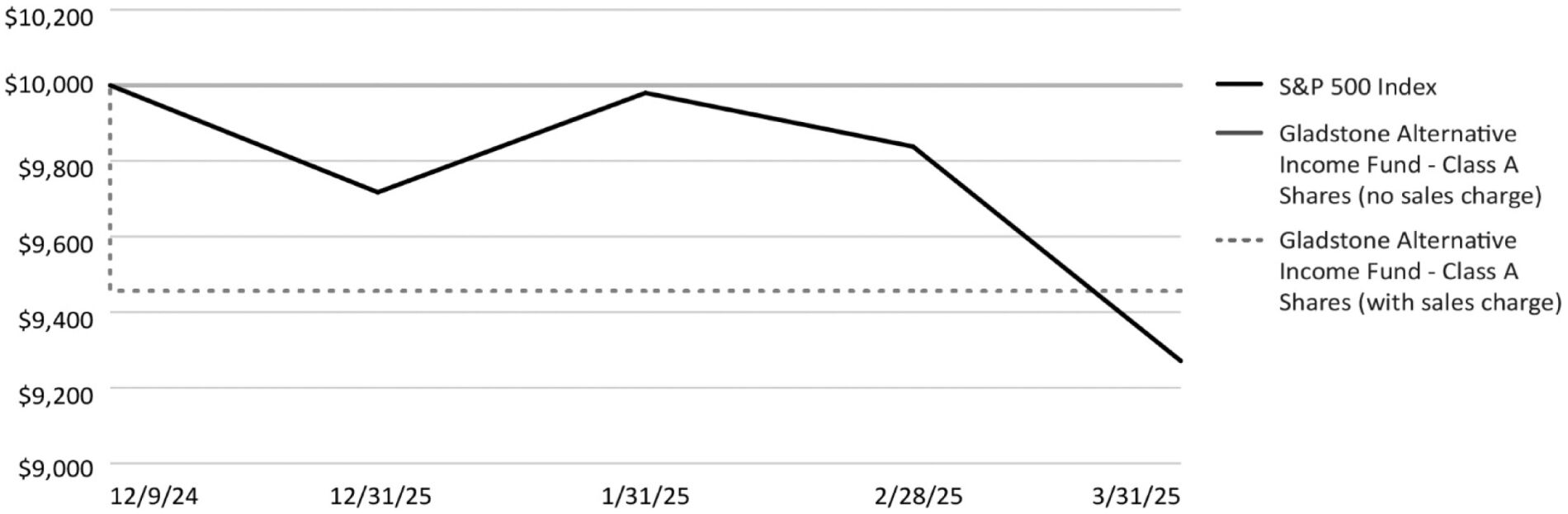

For the Period December 9, 2024 (Commencement of operations) to March 31, 2025 |

||||

NET ASSET VALUE, BEGINNING OF PERIOD |

$ | 10.00 | ||

INCOME FROM INVESTMENT OPERATIONS |

||||

Net investment income (a)

|

0.05 | |||

Total income from investment operations (a)

|

0.05 | |||

DISTRIBUTIONS |

||||

From net investment income (a)

|

(0.05 | ) | ||

Total distributions (a)

|

(0.05 | ) | ||

NET ASSET VALUE, END OF PERIOD |

$ | 10.00 | ||

TOTAL RETURN (b)

|

0.53 | % | ||

RATIOS AND SUPPLEMENTAL DATA |

||||

Net assets, end of period (000’s) |

$ | 234 | ||

RATIOS TO AVERAGE NET ASSETS |

||||

Ratio of gross expenses to average net assets |

17.79 | % (c) |

||

Ratio of expense waiver/reimbursements to average net assets |

(11.95 | %) (c) |

||

Ratio of net expenses to average net assets |

5.84 | % (c) |

||

Ratio of net investment income to average net assets |

1.53 | % (c) |

||

PORTFOLIO TURNOVER RATE |

0 | % | ||

|

(a) |

Per share numbers have been calculated using the average shares method. |

(b) |

Based on net asset value per share. Distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s Dividend Reinvestment Plan. Total return is not annualized for periods less than one year. |

(c) |

Annualized (except organizational costs and non-recurring expenses). |

| Annual Report | March 31, 2025 | 13 | |

| Gladstone Alternative Income Fund | Notes to Financial Statements | |

| March 31, 2025 |

| 14 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund | Notes to Financial Statements | |

| March 31, 2025 |

| Annual Report | March 31, 2025 | 15 | |

| Gladstone Alternative Income Fund | Notes to Financial Statements | |

| March 31, 2025 |

| 16 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund | Notes to Financial Statements | |

| March 31, 2025 |

| Annual Report | March 31, 2025 | 17 | |

| Gladstone Alternative Income Fund | Notes to Financial Statements | |

| March 31, 2025 |

| 18 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund | Notes to Financial Statements | |

| March 31, 2025 |

| Annual Report | March 31, 2025 | 19 | |

| Gladstone Alternative Income Fund | Notes to Financial Statements | |

| March 31, 2025 |

| 20 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund | Notes to Financial Statements | |

| March 31, 2025 |

| • | Level 1 – inputs to the valuation methodology are quoted prices (unadjusted) for identical financial instruments in active markets; |

| • | Level 2 – inputs to the valuation methodology include quoted prices for similar financial instruments in active or inactive markets, and inputs that are observable for the financial instrument, either directly or indirectly, for substantially the full term of the financial instrument. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists, or instances where prices vary substantially over time or among brokered market makers; and |

| Annual Report | March 31, 2025 | 21 | |

| Gladstone Alternative Income Fund | Notes to Financial Statements | |

| March 31, 2025 |

| • | Level 3 – inputs to the valuation methodology are unobservable and significant to the fair value measurement. Unobservable inputs are those inputs that reflect assumptions that market participants would use when pricing the financial instrument and can include the Valuation Team’s assumptions based upon the best available information. |

Investments in Securities at Value (a)

|

Level 1 - Quoted Prices |

Level 2 - Other Significant Observable Inputs |

Level 3 - Significant Unobservable Inputs |

Total |

||||||||||||

Debt Investments |

$ | — | $ | — | $ | 11,460,120 | $ | 11,460,120 | ||||||||

Equity Investments |

— | — | 1,778,597 | 1,778,597 | ||||||||||||

United States Treasury Obligations |

— | 9,998,597 | — | 9,998,597 | ||||||||||||

Short Term Investments |

5,753,059 | — | — | 5,753,059 | ||||||||||||

Total |

$ | 5,753,059 | $ | 9,998,597 | $ | 13,238,717 | $ | 28,990,373 | ||||||||

Equity Investments |

Debt Investments |

|||||||

Balance as of December 9, 2024 |

$ | — | $ | — | ||||

Change in Unrealized Appreciation/ Depreciation |

7,204 | (654 | ) | |||||

Purchases |

1,771,393 | 11,460,774 | ||||||

Balance as of March 31, 2025 |

$ | 1,778,597 | $ | 11,460,120 | ||||

Net change in unrealized appreciation/(depreciation) included in the Statements of Operations attributable to Level 3 investments held at March 31, 2025 |

$ | 7,204 | $ | (654 | ) | |||

| 22 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund | Notes to Financial Statements | |

| March 31, 2025 |

Quantitative Information about Level 3 Fair Value Measurements |

||||||||||||||

Fair Value as of |

Valuation Technique / |

Unobservable Input |

Range /Weighted- Average as of |

|||||||||||

March 31, 2025 |

March 31, 2025 |

|||||||||||||

Secured first lien debt and line of credit |

$ | 9,460,120 | Yield Analysis | Discount Rate | 9.3% - 13.4% / 12.6% |

|||||||||

Secured second lien debt |

2,000,000 | Yield Analysis | Discount Rate | 11.8% - 11.8% / 11.8% |

||||||||||

| EBITDA | ||||||||||||||

Preferred and common equity / equivalents |

1,778,597 | TEV | multiple | 3.7x – 6.7x /4.9x | ||||||||||

$10,600 -$25,038/ |

||||||||||||||

| TEV | EBITDA | $19,831 | ||||||||||||

Total Level 3 Investments, at Fair Value |

$ | 13,238,717 | ||||||||||||

Undistributed Ordinary Income |

Accumulated Capital Gains/ (Losses) |

Unrealized Appreciation/ (Depreciation) |

Other Cumulative Effect of Timing Differences |

Total |

||||||||||||||||

Gladstone Alternative Income Fund |

$ | 3,826 | $ | — | $ | 5,147 | $ | — | $ | 8,973 | ||||||||||

Ordinary Income |

Long-Term Capital

Gain |

|||||||

Gladstone Alternative Income Fund |

$ | 106,633 | $ | — | ||||

Cost of Investments for Income Tax Purposes |

Gross Appreciation (Excess of Value Over Tax Cost) |

Gross Depreciation (Excess of Tax Cost over Value) |

Net Appreciation/ (Depreciation) of Foreign Currency |

Net Unrealized Appreciation/ (Depreciation) |

||||||||||||||||

Gladstone Alternative Income Fund |

$ | 28,985,226 | $ | 7,204 | $ | (2,057 | ) | $ | — | $ | 5,147 | |||||||||

| Annual Report | March 31, 2025 | 23 | |

| Gladstone Alternative Income Fund | Notes to Financial Statements | |

| March 31, 2025 |

Fund |

Short-Term |

Long-Term |

||||||

Gladstone Alternative Income Fund |

$ | — | $ | — | ||||

Fund |

Purchases of Securities |

Proceeds From Sales of Securities |

||||||

Gladstone Alternative Income Fund |

$ | 33,220,006 | $ | 10,000,000 | ||||

| 24 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund | Notes to Financial Statements | |

| March 31, 2025 |

| Annual Report | March 31, 2025 | 25 | |

| Gladstone Alternative Income Fund | Notes to Financial Statements | |

| March 31, 2025 |

Expiration Period |

||||

Less than 1 year |

$ | — | ||

1-2 years |

— | |||

2-3 years |

1,096,997 | |||

Total |

$ | 1,096,997 | ||

| 26 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund | Notes to Financial Statements | |

| March 31, 2025 |

| Annual Report | March 31, 2025 | 27 | |

| Gladstone Alternative Income Fund |

Report of Independent Registered Public

Accounting Firm

|

| 28 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund | Additional Information (Unaudited) | |

| March 31, 2025 |

Aggregate Regular Compensation From the Fund |

Aggregate Special Compensation From the Fund |

Total Compensation From the Fund |

||||||||||

David Gladstone* |

$ | — | $ | — | $ | — | ||||||

Paula Novara* |

— | — | — | |||||||||

Michela A. English |

21,500 | — | 21,500 | |||||||||

Katharine C. Gorka |

20,750 | — | 20,750 | |||||||||

John H. Outland |

29,000 | — | 29,000 | |||||||||

Anthony W. Parker |

27,250 | — | 27,250 | |||||||||

Walter H. Wilkinson, Jr. |

25,000 | — | 25,000 | |||||||||

Total |

$ | 123,500 | $ | — | $ | 123,500 | ||||||

* |

Mr. Gladstone and Ms. Novara are interested persons of the Fund, within the meaning of Section 2(a)(19) of the 1940 Act, due to their positions as officers of the Fund and of the Adviser and their employment by the Adviser. |

| Annual Report | March 31, 2025 | 29 | |

| Gladstone Alternative Income Fund | Trustees & Officers (Unaudited) | |

| March 31, 2025 |

Name |

Position Held

(Length of Time

Served) |

Principal Occupation During Past 5 Years |

Number of Portfolios in Fund Complex (1)

Overseen by Trustee |

Other Directorships Held During Past 5 Years |

||||

|

INTERESTED TRUSTEES (2)

|

||||||||

|

David Gladstone |

Trustee, Chairman, Chief Executive Officer

(since inception)

|

Founder, Chief Executive Officer and Chairman of the Board of Gladstone Capital Corporation (“Gladstone Capital”) since its inception in 2001, of Gladstone Investment Corporation (“Gladstone Investment”) since its inception 2005, of Gladstone Commercial Corporation (“Gladstone Commercial”) since its inception in 2003, of Gladstone Land Corporation (“Gladstone Land”) since its inception in 1997 and of the Fund since its inception in 2024. Founder, Chief Executive Officer and Chairman of the Board of the Adviser. Since 2010, Mr. Gladstone also serves on the board of managers of the Distributor. Chief Executive Officer, President, Chief | 3 | Gladstone Capital; Gladstone Investment; Gladstone Commercial; Gladstone Land; Gladstone Acquisition |

| 30 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund | Trustees & Officers (Unaudited) | |

| March 31, 2025 |

Name |

Position Held

(Length of Time

Served) |

Principal Occupation During Past 5 Years |

Number of Portfolios in Fund Complex (1)

Overseen by Trustee |

Other Directorships Held During Past 5 Years |

||||

| Investment Officer. Chief Executive Officer, President, Chief Investment Officer and Director of Gladstone Acquisition from January 2021 until October 2022. | ||||||||

|

Paula Novara |

Trustee; Head of Resource Management

(since 2024)

|

Head of Human Resources, Facilities & Office Management and IT at Gladstone Capital, Gladstone Investment, Gladstone Commercial, Gladstone Land and the Fund since 2001, 2005, 2003, 1997, and 2024, respectively. | 3 | Gladstone Capital; Gladstone Investment; Gladstone Commercial; Gladstone Land | ||||

INDEPENDENT TRUSTEES |

||||||||

|

Michela A. English |

Trustee

(since 2024)

|

Private Investor and Director on multiple non-profit boards. |

3 | Gladstone Capital; Gladstone Investment; Gladstone Commercial; Gladstone Land; Gladstone Acquisition | ||||

|

Katharine C. Gorka |

Trustee

(since 2024)

|

President of Threat Knowledge Group, which provides training and expertise on threats to U.S. national security, since 2010, President of Revere Pay, Inc., and the chair of the Fairfax County Republican Party since 2024; senior policy advisor in the Office of Policy at the Department | 3 | Gladstone Capital; Gladstone Investment; Gladstone Commercial; Gladstone Land | ||||

| Annual Report | March 31, 2025 | 31 | |

| Gladstone Alternative Income Fund | Trustees & Officers (Unaudited) | |

| March 31, 2025 |

Name |

Position Held

(Length of Time

Served) |

Principal Occupation During Past 5 Years |

Number of Portfolios in Fund Complex (1)

Overseen by Trustee |

Other Directorships Held During Past 5 Years |

||||

| of Homeland Security from 2017 to 2020; press secretary for U.S. Customs and Border Protection in 2020; and Director for Civil Society at The Heritage Foundation from 2020 to 2022. | ||||||||

|

John H. Outland |

Trustee

(since 2024)

|

Private investor since June 2006. | 3 | Gladstone Capital; Gladstone Investment; Gladstone Commercial; Gladstone Land; Gladstone Acquisition | ||||

|

Anthony W. Parker |

Trustee

(since 2024)

|

Founder and Chairman of the Board of Parker Tide Corp., a federal government contracting company providing human resources, procurement and adjudication services to the federal government, with projects in 12 different states, since 1997. | 3 | Gladstone Capital; Gladstone Investment; Gladstone Commercial; Gladstone Land; Gladstone Acquisition | ||||

|

Walter H. Wilkinson, Jr. |

Trustee

(since 2024)

|

Founder and former General Partner of Kitty Hawk Capital, a venture capital firm, from its founding in 1980 through 2016. | 3 | Gladstone Capital; Gladstone Investment; Gladstone Commercial; Gladstone Land; Gladstone Acquisition | ||||

(1) |

The Fund Complex includes Gladstone Capital and Gladstone Investment, each a business development company advised by the Adviser. |

(2) |

Mr. Gladstone and Ms. Novara are interested persons of the Fund, within the meaning of Section 2(a)(19) of the 1940 Act, due to their positions as officers of the Fund and of the Adviser and their employment by the Adviser. |

| 32 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund |

Trustees & Officers (Unaudited)

|

|

| March 31, 2025 |

OFFICERS |

||||||

Name |

Position Held with the Fund |

Year Appointed |

Principal Occupation During Past 5 Years |

|||

|

John Sateri |

President | Since Inception | Managing Director of the Adviser since 2007. Investment Committee member of the Adviser for Gladstone Land, Gladstone Investment, Gladstone Capital and Gladstone Commercial since 2021. President of the Fund since 2024. | |||

|

Michael Malesardi |

Treasurer and Chief

Financial Officer

|

Since Inception | Chief Financial Officer and Treasurer of the Adviser since 2018. Chief Financial Officer and Treasurer of Gladstone Acquisition Corporation from January 2021 until October 2022. Chief Financial Officer and Treasurer of the Fund since 2024. | |||

|

Michael LiCalsi |

General Counsel and Secretary | Since Inception | General Counsel for each of Gladstone Capital, Gladstone Investment, Gladstone Commercial and Gladstone Land since October 2009 and Secretary of each since October 2012. President of the Administrator since July 2013. Managing Principal and Chief Legal Officer of the Distributor and member of its board of managers since October 2010. General Counsel and Secretary of Gladstone Acquisition Corporation from January 2021 until October 2022. General Counsel and Secretary of the Fund since 2024. | |||

| Annual Report | March 31, 2025 | 33 | |

| Gladstone Alternative Income Fund |

Board Consideration of Investment

Advisory Agreement

|

|

| March 31, 2025 (Unaudited) |

| 34 | www.gladstoneintervalfund.com |

| Gladstone Alternative Income Fund |

Board Consideration of Investment

Advisory Agreement

|

|

| March 31, 2025 (Unaudited) |

| Annual Report | March 31, 2025 | 35 | |

| Gladstone Alternative Income Fund | Investor Data Privacy Notice | |

| March 31, 2025 (Unaudited) |

| • | information we receive from shareholders. This includes shareholders’ communications to us concerning their investment; |

| • | information about shareholders’ transactions and history with us; or |

| • | other general information that we may obtain about shareholders, such as demographic and contact information (such as a shareholder’s address). |

| • | to our affiliates (such as the Adviser and the Administrator) and their employees that have a legitimate business need for the information. The degree of access is based on the sensitivity of the information and on personnel need for the information to service a shareholder’s account or comply with legal requirements; |

| • | to our service providers (such as our administrators, accountants, attorneys, custodians, transfer agent, underwriters and proxy solicitors) and their employees as is necessary to service shareholder accounts or otherwise provide the applicable service; |

| • | to comply with court orders, subpoenas, lawful discovery requests, or other legal or regulatory requirements; or |

| • | as allowed or required by applicable law or regulation. |

| 36 | www.gladstoneintervalfund.com |

| (b) | Not applicable. |

Item 2. Code of Ethics.

| (a) | As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| (c) | During the period covered by this report, there were no amendments to the registrant’s Code of Ethics. |

| (d) | During the period covered by the report, the registrant has not granted any express or implicit waivers from the provisions of the code of ethics. |

| (e) | Not applicable. |

| (f) | The registrant’s code of ethics referred to in Item 2(a) above is attached as Exhibit 19(a)(1) hereto. |

Item 3. Audit Committee Financial Expert.

| (a) | The registrant’s board of trustees have determined that the registrant has at least one audit committee financial expert serving on its audit committee. The registrant’s board of trustees have determined that Anthony W. Parker is an audit committee financial expert. Mr. Parker is “independent” as defined in paragraph (a)(2) of Item 3 to Form N-CSR. |

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees |

March 31, 2025 - $181,000

Audit fees represent the aggregate fees expected to be billed for the period December 9, 2024 (commencement of operations) through March 31, 2025 for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements.

| (b) | Audit-Related Fees |

March 31, 2025 - $0

The registrant was not billed for any fees for the period December 9, 2024 (commencement of operations) through March 31, 2025 for assurance and related services that were reasonably related to the performance of the audit of the registrant’s financial statement and not otherwise included under “Audit Fees” above.

| (c) | Tax Fees |

March 31, 2025 - $0

“Tax fees” shown above represent the aggregate fees expected to be billed for the preparation of Federal & State income tax returns, assistance with calculation of required income, capital gain and excise distributions and preparation of Federal excise tax returns for the period December 9, 2024 (commencement of operations) through March 31, 2025.

-2-

| (d) | All Other Fees |

March 31, 2025- $0

The registrant was not billed any fees for products and services not otherwise included in items (a) – (c) shown above for the period December 9, 2024 (commencement of operations) through March 31, 2025.

| (e) | (1) Audit Committee’s Pre-Approval Policies and Procedures |

The Audit Committee is required to pre-approve the audit and non-audit services performed by PricewaterhouseCoopers LLC (the “Auditor”) in order to ensure that the provision of such services to the registrant does not impair the independence of the Auditor. Unless a type of service to be provided by the Auditor has received general pre-approval, it will require specific pre-approval by the Audit Committee. Any proposed services exceeding pre-approved fee levels will require specific pre-approval by the Audit Committee.

(2) Percentages of Services Approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

| 2025 | ||||

| Audit Related |

— | % | ||

| Tax Fees |

— | % | ||

| Other Fees |

N/A | |||

| (f) | During the audit of registrant’s financial statements for the most recent fiscal year, less than 50 percent of the hours expended on the principal accountant’s engagement were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees. |

| (g) | The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the Gladstone Management Corporation, the registrant’s investment adviser (the “Adviser”) (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the Adviser that provides ongoing services to the registrant for the period December 9, 2024 (commencement of operations) through March 31, 2025: $0. |

| (h) | The registrant’s audit committee has considered whether the provision of non-audit services to the Adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the Adviser that provides ongoing services to the registrant, that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, is compatible with maintaining the principal accountant’s independence |

| (i) | Not applicable. |

| (j) | Not applicable. |

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrant.

Item 6. Investments.

| (a) | The schedule of investments is included as part of the Annual Report to Stockholders filed under Item 1(a) of this report. |

-3-

| (b) | Not applicable to registrant. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Not applicable to registrant.

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable to registrant.

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

Not applicable to registrant.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Not applicable to registrant.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

The Statement Regarding Basis for Approval of Investment Advisory Contract for the registrant is included as part of the Annual Report to Stockholders filed under Item 1.

See attached Appendix A for the Adviser’s proxy voting policy.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

| (a)(1) | Identification of Portfolio Manager(s) or Management Team Members and Description of Role of Portfolio Manager(s) or Management Team Members |

Portfolio Managers

The following are the portfolio managers as of the date of the filing of this report who is responsible for the day-to-day management of the registrant’s portfolio and the selection of its investments.

| Name |

Position(s) Held with Trust |

Principal Occupations Last 5 Years |

||

| David Gladstone | Trustee, Chairman, Chief Executive Officer | Founder, Chief Executive Officer and Chairman of the Board of Gladstone Capital Corporation (“Gladstone Capital”) since its inception in 2001, of Gladstone Investment Corporation (“Gladstone Investment”) since its inception 2005, of Gladstone Commercial Corporation (“Gladstone Commercial”) since its inception in 2003, of Gladstone Land Corporation (“Gladstone Land”) since its inception in 1997 and of the registrant since its inception in 2024. Founder, Chief Executive Officer and Chairman of the |

-4-

| Board of the Adviser. Since 2010, Mr. Gladstone also serves on the board of managers of Gladstone Securities, LLC (the “Distributor”). Chief Executive Officer, President, Chief Investment Officer. Chief Executive Officer, President, Chief Investment Officer and Director of Gladstone Acquisition Corporation from January 2021 until October 2022. | ||||

| John Sateri | President | Managing Director of the Adviser since 2007 and President of the registrant since its inception in 2024. Investment Committee member of the Adviser for Gladstone Land, Gladstone Investment, Gladstone Capital and Gladstone Commercial since 2021 and of the registrant since 2024. | ||

| Laura Gladstone | Portfolio Manager | Managing Director of the Adviser since 2001. Investment Committee member of the Adviser for Gladstone Land, Gladstone Investment, Gladstone Capital and Gladstone Commercial since 2021 and of the registrant since 2024. | ||

(a)(2) Other Accounts Managed by Portfolio Manager(s) or Management Team Member and Potential Conflicts of Interest

Other Accounts Managed by Portfolio Manager(s) or management Team

As of March 31, 2025:

| Name of Portfolio Manager or Team Member |

Type of Accounts |

Total No. of Accounts Managed |

Total Assets (millions) |

No. of Accounts where Advisory Fee is Based on Performance |

Total Assets in Accounts where Advisory Fee is Based on Performance (millions) |

|||||||||||||

| David Gladstone |

Registered Investment Companies: | — | — | — | — | |||||||||||||

| Other Pooled Investment Vehicles: | 4 | $ | 4,225.4 | 4 | $ | 4,225.4 | ||||||||||||

| Other Accounts: | — | — | — | — | ||||||||||||||

| John Sateri |

Registered Investment Companies: | — | — | — | — | |||||||||||||

| Other Pooled Investment Vehicles: | 4 | $ | 4,225.4 | 4 | $ | 4,225.4 | ||||||||||||

| Other Accounts: | — | — | — | — | ||||||||||||||

| Laura Gladstone |

Registered Investment Companies: | — | — | — | — | |||||||||||||

| Other Pooled Investment Vehicles: | 4 | $ | 4,225.4 | 4 | $ | 4,225.4 | ||||||||||||

| Other Accounts: | — | — | — | — | ||||||||||||||

-5-

Potential Conflicts of Interest

Our executive officers and trustees, and the officers and directors of the Adviser, serve or may serve as officers, directors, or principals of entities that operate in the same or a related line of business as we do or of investment funds managed by our affiliates. Accordingly, they may have obligations to investors in those entities, the fulfillment of which might not be in our or our shareholders’ best interests. For example, Mr. Gladstone, our chairman and chief executive officer, is the chairman of the board and chief executive officer of the Adviser, Gladstone Administration, LLC (the “Administrator”), the Distributor, and each of the publicly traded business development companies and real estate investment trusts managed by the Adviser. In addition, Mr. Sateri, our president, is also Managing Director of the Adviser. Mr. Malesardi, our chief financial officer, is also chief financial officer of the Adviser. While portfolio managers and the officers and other employees of the Adviser devote as much time to the management of us as appropriate to enable the Adviser to perform its duties in accordance with the investment advisory agreement (the “Advisory Agreement”) between the registrant and the Adviser, the portfolio managers and other of the Adviser’s officers may have conflicts in allocating their time and services among us, on the one hand, and other investment vehicles managed by the Adviser, on the other hand. These activities could be viewed as creating a conflict of interest insofar as the time and effort of the portfolio managers and the officers and employees of the Adviser will not be devoted exclusively to our business but will instead be allocated between our business and the management of these other investment vehicles. Moreover, the Adviser may establish or sponsor other investment vehicles which from time to time may have potentially overlapping investment objectives with ours and accordingly may invest in, whether principally or secondarily, asset classes we target. While the Adviser generally has broad authority to make investments on behalf of the investment vehicles that it advises, the Adviser has adopted investment allocation procedures to address these potential conflicts and intends to direct investment opportunities to us or the other funds that are managed by the Adviser with the investment strategy that most closely fits the investment opportunity. Nevertheless, the management of the Adviser may face conflicts in the allocation of investment opportunities to other entities it manages. As a result, it is possible that we may not be given the opportunity to participate in certain investments made by other funds managed by the Adviser.

In certain circumstances, we may make investments in a portfolio company in which one of our affiliates has or will have an investment, subject to satisfaction of any regulatory restrictions and, where required, the prior approval of our Board of Trustees. As of October 1, 2024, the Board has approved the following types of transactions:

| • | Our affiliates, Gladstone Commercial and Gladstone Land, may, under certain circumstances, lease property to portfolio companies that we do not control. We may pursue such transactions only if (i) the portfolio company is not controlled by us or any of our affiliates, (ii) the portfolio company satisfies the tenant underwriting criteria of Gladstone Commercial or Gladstone Land, as applicable, and (iii) the transaction is approved by a majority of our independent trustees and a majority of the independent directors of Gladstone Commercial or Gladstone Land, as applicable. We expect that any such negotiations between Gladstone Commercial or Gladstone Land and our portfolio companies would result in lease terms consistent with the terms that the portfolio companies would be likely to receive were they not portfolio companies of ours. |

| • | We may invest simultaneously with Gladstone Capital or Gladstone Investment in senior loans in the broadly syndicated market whereby neither we nor any affiliate has the ability to dictate the terms of the loans. |

| • | Pursuant to the Co-Investment Order, we may co-invest, under certain circumstances, with certain of our affiliates, including Gladstone Capital, Gladstone Investment and any future business development company or closed-end management investment company that is advised (or sub-advised if it controls the fund) by the Adviser, or any combination of the foregoing subject to the conditions in the Co-Investment Order. |

-6-

Certain of our officers, who are also officers of the Adviser, may from time to time serve as directors of certain of our portfolio companies. If an officer serves in such capacity for one of our portfolio companies, such officer will owe fiduciary duties to stockholders of the portfolio company, which duties may from time to time conflict with the interests of our shareholders.

In the course of our investing activities, we will pay management and incentive fees to the Adviser and will reimburse the Administrator for certain expenses it incurs. As a result, investors in the shares of the registrant will invest on a “gross” basis and receive distributions on a “net” basis after expenses, resulting in, among other things, a lower rate of return than one might achieve through our investors themselves making direct investments. As a result of this arrangement, there may be times when the management team of the Adviser has interests that differ from those of our shareholders, giving rise to a conflict.

(a)(3) Compensation Structure of Portfolio Manager(s) or Management Team Members

As of March 31, 2025:

The Portfolio Managers receive compensation from the Adviser in the form of a base salary plus bonuses. Each Portfolio Manager’s base salary is determined by a review of salary surveys for persons with comparable experience who are serving in comparable capacities in the industry. Each Portfolio Manager’s base salary is set and reviewed yearly. Like all employees of the Adviser, a Portfolio Manager’s bonuses are tied to the post-tax performance of the Adviser and the entities that it advises. A Portfolio Manager’s bonuses increases or decreases when the Adviser’s income increases or decreases. The Adviser’s income, in turn, is directly tied to the management and incentive fees earned in managing its investment funds, including us. Pursuant to the Advisory Agreement, the Adviser receives a management fee and an incentive fee based on net investment income in excess of the hurdle rates as set out in the Advisory Agreement.

(a)(4) Disclosure of Securities Ownership

As of March 31, 2025, the Portfolio Managers ownership of the registrant was as follows:

| Portfolio Managers |

Dollar Range of Shares Owned | |

| David Gladstone |

over $1,000,000 | |

| John Sateri |

$50,001-$100,000 | |

| Laura Gladstone |

none |

| (b) | Not Applicable. |

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

None.

Item 15. Submission of Matters to a Vote of Security Holders.

None.

Item 16. Controls and Procedures.

| (a) | Based on an evaluation of the registrant’s disclosure controls and procedures as of a date within 90 days of filing date of this Form N-CSR, the principal executive officer and principal financial officer of the registrant have concluded that the disclosure controls and procedures of the registrant are reasonably designed to ensure that the information required in filings on Form N-CSR is recorded, processed, summarized, and reported within 90 days of the filing date, including that information required to be disclosed is accumulated and communicated to the registrant’s management, including the registrant’s principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure. |

-7-

| (b) | There were no changes in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

| (a) | Not applicable. |

| (b) | Not applicable. |

Item 18. Recovery of Erroneously Awarded Compensation.

| (a) | Not applicable. |

| (b) | Not applicable. |

Item 19. Exhibits.

| (a)(1) |

| (a)(2) | Not applicable. |

| (a)(3) |

| (a)(4) | Not applicable. |

| (a)(5) | Not applicable |

| (b) |

-8-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Gladstone Alternative Income Fund

| By: | /s/ David Gladstone |

|

| David Gladstone | ||

| Chief Executive Officer | ||

| (principal executive officer) | ||

| Date: | June 5, 2025 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ David Gladstone |

|

| David Gladstone | ||

| Chief Executive Officer | ||

| (principal executive officer) | ||

| Date: | June 5, 2025 | |

| By: | /s/ Michael Malesardi |

|

| Michael Malesardi | ||

| Chief Financial Officer | ||

| (principal financial officer) | ||

| Date: | June 5, 2025 | |

-9-